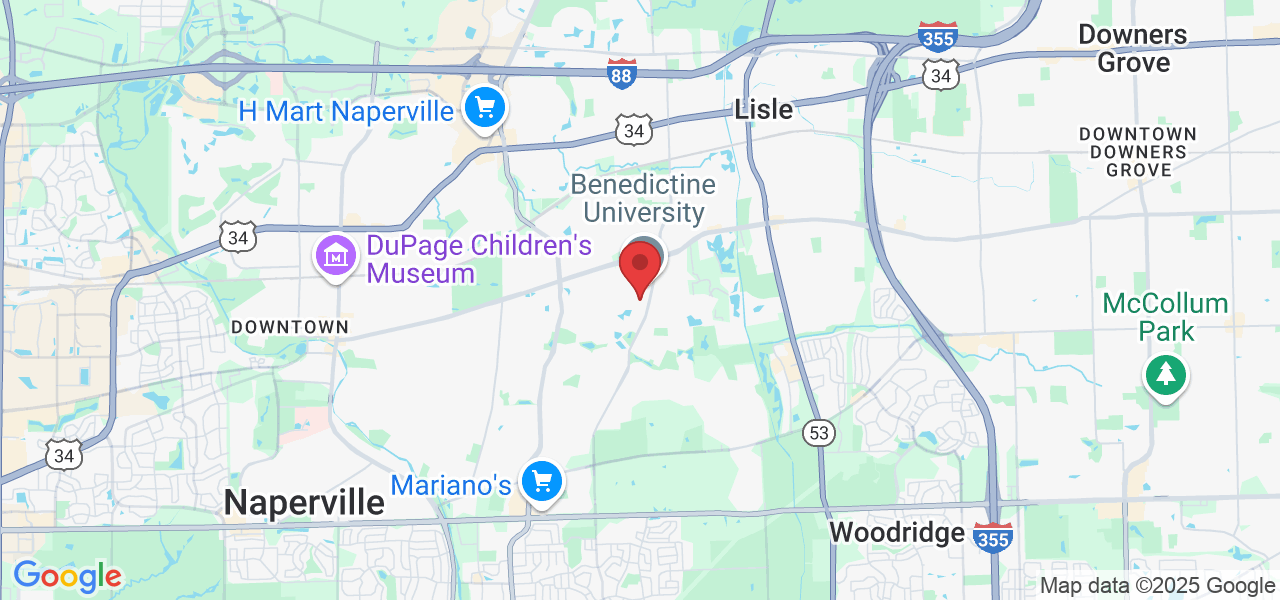

Two Day Educational Workshop at Benedictine University; Lisle Campus - Kindlon Hall

Retirement Ready Masterclass

Event Details:

Location: Benedictine University; Lisle Campus - Kindlon Hall

Date: Tuesday, May 13 and Tuesday, May 20 OR Thursday, May 15 and Thursday, May 22

Time: 6:30 - 8:30pm

Address: 5794 College Rd #5750; Lisle, Illinois 60532

This workshop is a comprehensive two day Retirement Workshop requiring a four-hour time commitment. A $29 tuition fee is required to attend.

Protect your nest egg from new legislation, tax hikes, inflation, market volatility, and today's uncertain economy.

Planning for retirement can be daunting, but with the right guidance, you can navigate this journey with confidence. Our upcoming two-day-workshop is designed to equip you with essential strategies to ensure a secure and fulfilling retirement.

What we’ll cover:

Retirement Income Planning:

Diversify Income Sources: Combine Social Security, pensions, and personal savings to create a stable income stream.

Sequence Withdrawals Strategically: Plan the order of withdrawals from taxable, tax-deferred, and tax-free accounts to minimize taxes.

Exploring Guaranteed Income For Life Solutions: Explore solutions that could provide guaranteed income during retirement.

Social Security Maximization:

Delay Benefits: Postponing Social Security claims can result in higher monthly benefits.

Understand Tax Implications: Be aware of how Social Security benefits are taxed based on other income sources.

Coordinate with Spouse: Married couples should strategize benefit claims to maximize combined income.

Taxes & Retirement:

Leverage Roth Accounts: Utilize Roth IRAs for tax-free withdrawals during retirement.

Understand IRMAA (Income-Related Monthly Adjustment Amount): Higher retirement income can increase Medicare premiums—learn how to manage income levels to avoid unexpected costs.

Estate Planning:

Avoid Unnecessary Taxes for Your Heirs: Properly structure your assets to minimize estate and inheritance taxes, ensuring more of your wealth goes to your loved ones.

Use Tax-Efficient Inheritance Strategies: Consider strategies like Roth conversions, gifting during your lifetime, and setting up trusts to reduce the tax burden on your beneficiaries.

And much more!

This workshop is a comprehensive Retirement Workshop requiring a four-hour time commitment. A $29 tuition fee is required to attend. You will leave with the knowledge and confidence to make better financial decisions in all areas of your retirement.

Space is limited, so fill out the registration form here to reserve your seat today.

Event Registration

Seating is limited. Sign up today to guarantee your seat(s)!

Tuition for the Tuesday, May 13th and Tuesday, May 22nd event include a 2-night, 4-hour course designed to teach you the principles of retirement planning and course materials.

Tuition for the Thursday, May 15th and Thursday, May 22nd event include a 2-night, 4-hour course designed to teach you the principles of retirement planning and course materials.

By clicking “Register Now” I provide my express written consent to receive event updates, marketing calls or texts (by automatic dialer or otherwise), and emails from “My Path to Retirement”, its affiliates or representatives. I understand that my consent is not a condition of purchasing any property, goods, or services and that I may revoke my consent at any time. By attending this event, I understand that I may be contacted for a discussion of insurance & investment products or to enter into an advisory relationship.

About Your Presenter

Elliott Vaughn, CFP®

Certified Financial Planner™

A Roosevelt University graduate with a degree in mathematics/actuarial science, is a numbers enthusiast with a passion for planning. He’s always found comfort in spreadsheets, his trusty calculator “Pat,” and a steaming cup of coffee.

Elliott’s transition from studying calculus and proofs to delving into tax and estate law was natural. He thrives on applying his analytical skills to help clients optimize their financial situations. His motto, “You know how to spend your money better than Uncle Sam does,” reflects his dedication to reducing clients’ lifetime tax burdens through honest and legal strategies.

Beyond taxes, Elliott leverages his understanding of risk to craft personalized investment portfolios. He recognizes the crucial difference between seeking excess returns and fearing market downturns. His proactive approach to reviewing client allocations and setting clear expectations ensures a confident and informed investment journey.

With nearly a decade of industry experience, Elliott’s career is defined by a commitment to providing exceptional value. As a CFP®, he adheres to the highest ethical standards and fiduciary duty, putting his client’s interests first. His ethos, “The value I provide should be some sort of multiple of the fee I charge,” underscores his dedication to exceeding client expectations and delivering tangible results.

While he takes pride in always being available to clients, his first pride is in his son, Graham. When he’s not in the office, Elliott spends time with his family and dog.

Any Questions Regarding This Event Call:

(872) 253-6511

Frequently Asked Questions

Is there a cost to attend?

This workshop is a comprehensive Retirement Workshop requiring a two-day, four-hour time commitment. A $29 tuition fee is required to attend.

Do I need to bring anything?

No, you will be provided with pen and paper to take notes.

Will any investments or investment products be discussed?

No there will not be any discussion of any investments whatsoever.

Will I be pitched or sold anything?

No. Our classes are strictly educational. The most common feedback we receive is how nice it is to attend a truly educational workshop with no pressure.

Is this sponsored by the Social Security administration?

The Presenter is not affiliated with the Social Security administration or any other government agency

Disclaimer: Investment advice offered through IHT Wealth Management, a registered investment advisor. This presentation is for informational purposes only and should not be construed as financial, tax, or legal advice. Individual circumstances vary. Please consult with a qualified financial advisor, tax professional, and/or attorney for personalized guidance. IHT Wealth Management, an RIA, and Harbor Wealth, its DBA, do not provide tax or legal advice.

Investment Risks: Investing involves risk, including the potential for loss of principal. Past performance is not indicative of future results. The value of investments can fluctuate significantly, and there is no guarantee that you will achieve your investment objectives.

Retirement Planning: Retirement planning involves numerous factors, including but not limited to: age, health, income, expenses, savings, investment goals, and risk tolerance. This presentation may not address all relevant factors specific to your individual situation. Retirement income strategies may be subject to market volatility and legislative changes.

Tax Considerations: Tax laws and regulations are complex and subject to change. This presentation does not constitute tax advice, and you should consult with a qualified tax professional for guidance on your specific tax situation. Tax strategies may have unintended consequences and may not be suitable for all investors.

Important Notes: This presentation may contain forward-looking statements that are based on current expectations and are subject to uncertainty and change. IHT Wealth Management and Harbor Wealth assume no responsibility for any errors or omissions in this presentation. This presentation may include third-party materials, which are not endorsed or guaranteed by IHT Wealth Management or Harbor Wealth.

Confidentiality: The information presented in this seminar is confidential and should not be shared without the express written consent of IHT Wealth Management or Harbor Wealth.

This is a sample disclosure and may not be comprehensive. It is essential to consult with legal and compliance professionals to ensure that your disclosures are accurate, complete, and in compliance with all applicable regulations.

GET IN TOUCH

MAILING ADDRESS

My Path to Retirement

505 North 210th Street

Elkhorn, NE 68022

PHONE NUMBER

Phone: (816) 702-5158

The information contained herein is based on our understanding of current tax law. The tax and legislative information may be subject to change and different interpretations. We recommend that you seek professional legal advice for applicability to your personal situation.

This presentation is not intended to be legal or tax advice. The presenter can provide information, but not advice related to social security benefits. Clients should seek guidance from the Social Security Administration regarding their particular situation. The presenter may be able to identify potential retirement income gaps and may introduce insurance products, such as an annuity, as a potential solution. Social Security benefit payout rates can and will change at the sole discretion of the Social Security Administration. For more information, please consult a local Social Security Administration office, or visit www.ssa.gov.